Welcome to our August 2024 Real Estate Market Update! As we explore the latest trends and developments influencing the real estate landscape this summer, join us for a detailed look at key market indicators, emerging opportunities, and expert forecasts. Whether you’re a buyer, seller, investor, or just interested in the current housing market, this update offers valuable insights to help you make informed decisions in the ever-changing world of real estate. Let’s navigate the currents of August 2024 together and discover what the future holds for property and housing.

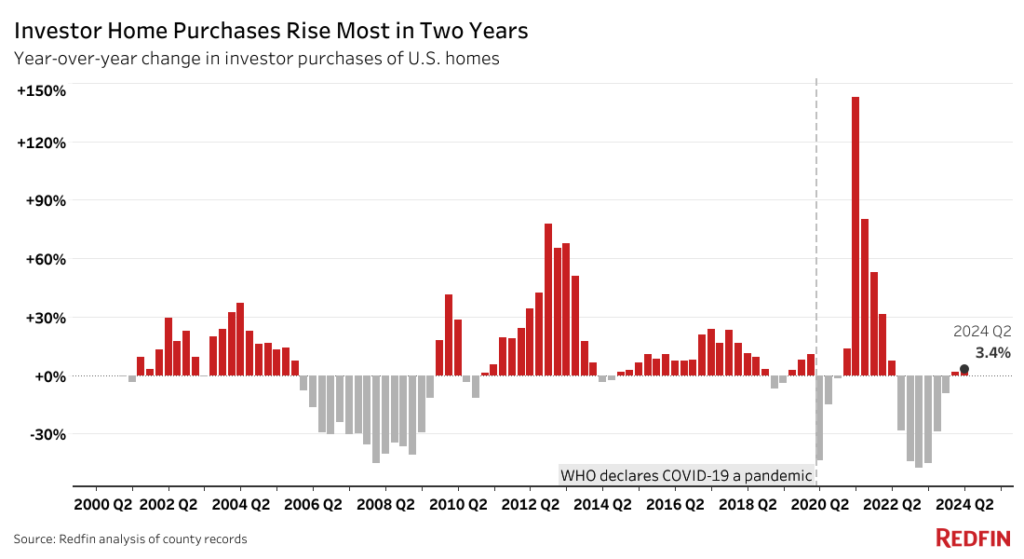

Investor Home Purchases See Largest Rise in Two Years

In the second quarter of 2024, investor home purchases experienced their most substantial increase in two years. This notable rise in buying activity indicates a robust rebound in investor confidence and market opportunities. Investors were more active in acquiring properties, driven by favorable market conditions and an attractive investment environment. The increase was widespread, affecting various regions and showing a significant shift in the housing market dynamics. This surge highlights a growing optimism among investors about the potential returns and opportunities within the real estate sector.

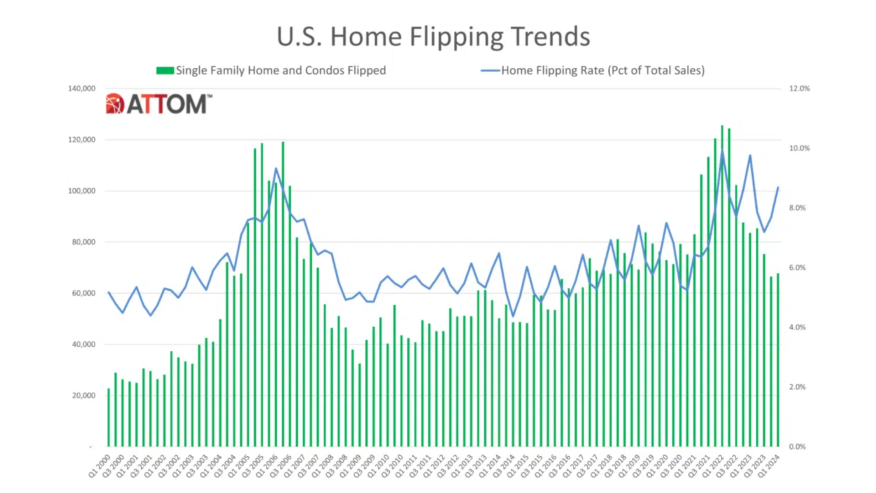

Home Flipping Activity and Profits Increase in Q1 2024

In the first quarter of 2024, home flipping saw a notable uptick in both activity and profitability. Investors increased their engagement in purchasing, renovating, and reselling properties, which led to higher profit margins. This surge in home flipping was fueled by favorable market conditions, including rising home values and strong demand from buyers. As a result, the sector experienced a significant boost, with investors reaping greater financial rewards from their flipping ventures. This trend underscores a robust and thriving segment within the real estate market during this period.

The U.S. Housing Market Approaches $50 Trillion in Value, as the Number of Trillion-Dollar Metros Doubles

As of June 2024, the U.S. housing market is approaching a total value of $50 trillion, showcasing its immense scale and significance within the economy. This impressive figure underscores the continued strength and resilience of the real estate sector, even as market conditions evolve. The increase in overall market value reflects a combination of rising property prices, high demand, and sustained investor interest across various regions.

Additionally, the number of metropolitan areas with housing markets exceeding $1 trillion has now doubled. This surge in high-value metros highlights a growing concentration of wealth and investment in key cities. The expansion of these trillion-dollar markets points to substantial economic activity and robust demand in these regions, further illustrating the dynamic nature of the U.S. housing market.

Sources:

Sources: redfin. Forbes. attom.