Welcome to our July 2024 Real Estate Market Update! As we dive into the latest trends and developments shaping the real estate landscape this summer, join us for an insightful exploration of key market indicators, emerging opportunities, and expert predictions. Whether you’re a buyer, seller, investor, or simply curious about the state of the housing market, this update will provide valuable insights to guide your decisions in the dynamic world of real estate. Let’s navigate together through the currents of July 2024 and uncover what lies ahead in the realm of property and housing.

Despite record-high prices, the current summer season presents homebuyers with an opportunity due to declining mortgage rates and an increasing supply

Homebuyers with a $3,000 monthly budget have seen their purchasing power increase by over $20,000 since mortgage rates peaked in the spring. Prospective buyers who have been waiting for mortgage rates to decrease may want to act quickly. Rates recently fell to their lowest point since March following the latest inflation report, while the inventory of homes for sale is growing. This creates an advantageous window before competition intensifies. At today's average daily rate of 6.85%, a homebuyer on a $3,000 monthly budget can afford a home priced at $447,750. By comparison, when rates hit a five-month high of 7.5% in April, the same budget could only support a $425,500 home—an increase of $22,250 in purchasing power. Looking at affordability from another angle, the monthly mortgage payment for a typical U.S. home valued at approximately $400,000 would be $2,647 with today's 6.85% rate. This represents a reduction of nearly $200 from $2,814 when rates were 7.5%. With mortgage rates expected to continue a slight decline ahead of potential interest rate cuts by the Federal Reserve, it's improbable they will dip below 6% by year-end. While lower mortgage rates offer relief, home prices remain at historic highs and are unlikely to drop significantly in the near term. Buyers should consider current opportunities amidst this complex market landscape.

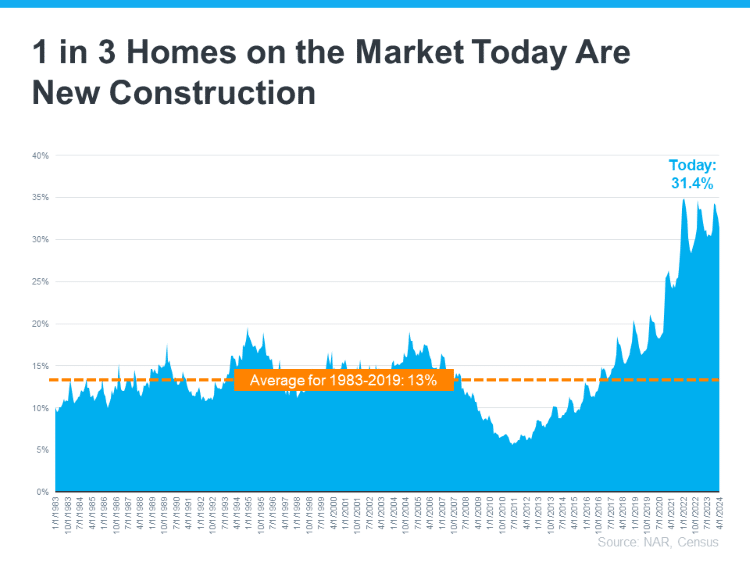

New Construction shows steady footing in the Real Estate Market

The recent increase in home inventory can be largely attributed to the ongoing efforts of new construction home builders, who have been actively adding new units to the market.

According to data from the National Association of Realtors (NAR) and Census data compiled by Keeping Current Matters as of June 2024, over one-third (>33%) of the homes currently available on the market are newly constructed. Historically, this figure has hovered around 13%. This surge in new inventory is significantly easing the demand for homebuyers in search of new properties.

Foreign acquisitions of U.S. homes have dropped to their lowest recorded level.

New data released by the National Association of Realtors reveals a significant decline in foreign purchases of U.S. homes, marking the lowest levels since tracking began in 2009.

During the period from April 2023 to March 2024, international buyers acquired $42 billion worth of U.S. homes, reflecting a sharp 21.2% decrease compared to the previous year. The number of homes purchased by foreign buyers also plummeted by 36% to 54,300 units, marking a record low.

Several factors contribute to this decline. Some states have implemented restrictions on non-U.S. purchases, although experts assert that other factors have played a role as well. Challenges such as limited housing inventory, soaring prices, and higher borrowing rates have affected both domestic and international buyers alike.

“The historically low housing inventory and rising prices continue to restrain home sales for Americans and international buyers,” noted Lawrence Yun, chief economist at NAR. “Furthermore, the strength of the U.S. dollar has made international travel more affordable for Americans but has simultaneously increased the cost of U.S. homes for foreigners. These dynamics have understandably led to a reduction in foreign purchases of U.S. real estate.”

As explained by Realtor.com “There were 30.4% more homes actively for sale on a typical day in April compared to the same time in 2023, marking the sixth consecutive month of annual inventory growth.”

But does this increased inventory make house hunting easier? The answer is both yes and no.

The graph below, using the latest weekly data from Calculated Risk, indicates that despite recent growth, the number of homes for sale is still significantly lower than in the last normal year for the housing market:

Sources:

Redfin. Keeping Current Matters. Realtor.com. Forbes.com