Welcome to the October 2024 Real Estate Market Update! As we embrace the beauty of fall, it’s time to stay informed about the evolving housing landscape. Join us for an engaging exploration of the latest trends, exciting opportunities, and expert predictions. Whether you’re buying, selling, investing, or simply curious, this update is filled with insights to help you navigate today’s dynamic market. Let’s dive into the October real estate journey together and discover what the future holds!

Homebuying demand remains resilient despite election uncertainty and a stronger-than-expected economy driving up interest rates

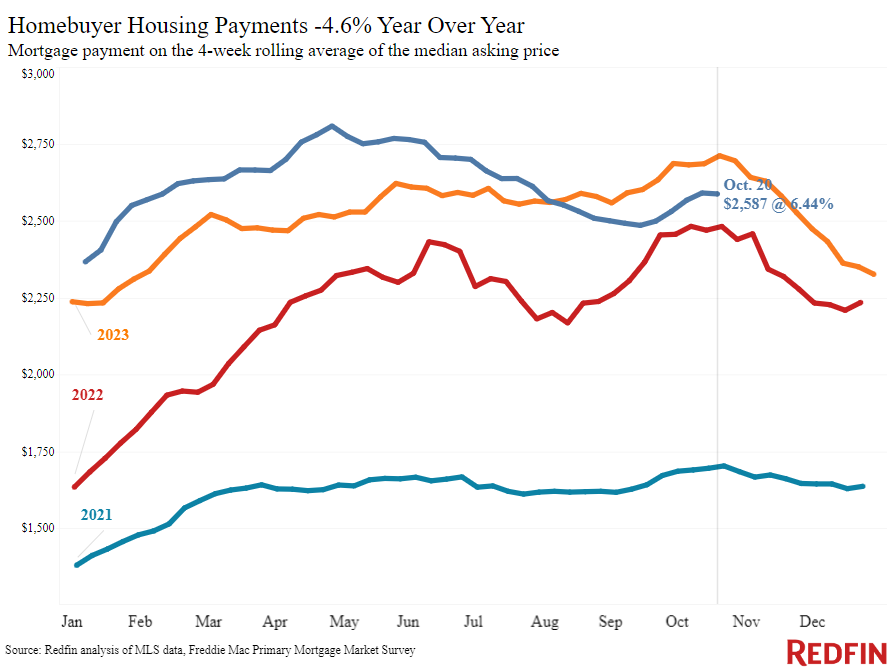

Pending home sales and tours are strong despite rising mortgage rates and election uncertainty. As of October 20, pending U.S. home sales increased by 3.5% year over year, with many major metros seeing gains. Mortgage rates are currently averaging 6.44%, driven by concerns about potential government spending after the election and stronger economic data. This has pushed the median monthly housing payment to $2,587. While new listings have only increased by 2.2% annually, buyers are active, particularly in desirable locations, though they are negotiating prices and seeking concessions. Many potential buyers and sellers are waiting until after the election due to market uncertainty.

U.S. home prices increased by 0.5% in September, marking the quickest growth since April.

In September, U.S. home prices rose 0.5% from the previous month, the fastest growth since April and marking the third consecutive month of increasing rates. Year-over-year, prices climbed 6%, the lowest annual increase since December.

According to the Redfin Home Price Index, which tracks price changes for single-family homes, affordability improved in September as mortgage rates fell to around 6.08%. However, home prices continue to rise due to higher demand than supply. There are about 20% fewer homes on the market compared to five years ago, largely because many homeowners locked in low rates during the pandemic. With current mortgage rates above 6.5%, prices are expected to keep increasing until more inventory becomes available in the spring.

In September, 13 of the 50 largest U.S. metros saw a month-over-month decline in home prices. San Antonio, TX, experienced the largest drop at -1%, while Nassau County, NY, recorded the highest gain at +1.7%.

Mortgage rates are unlikely to change significantly following a stronger-than-expected CPI report.

The slightly higher-than-expected September inflation report is likely to keep mortgage rates stable after the recent surge following last Friday’s strong jobs report. The Federal Reserve may consider a 25 basis point rate cut at their November 7 meeting, depending on the upcoming jobs report on November 1.

Core CPI, which excludes food and energy, increased by 0.3% month over month and 3.3% year over year, slightly above expectations. Shelter inflation, a key contributor to overall inflation, fell to 0.2% month over month, which may indicate a potential decline ahead. However, a rise in medical care services inflation added to the overall CPI, though this category can be volatile.

While mortgage rates have risen about 50 basis points since the jobs report, they remain lower than last year’s rates and the peak from spring. Market expectations for Fed rate cuts have adjusted to align more closely with the Fed’s projections. The upcoming jobs report on November 1 will be crucial in determining the strength of the job market and its impact on future mortgage rates.

Sources:

Sources: redfin. Forbes. attom.