Welcome to the February 2025 Real Estate Market Update—where the market is heating up even as winter lingers! This month, we’re kicking off the year with fresh opportunities and unexpected twists that’ll keep you on your toes. February might be known for love, but we’re all about the love for smart investments, big moves, and bold strategies. The market is buzzing with new trends, challenges, and chances to make your next big move.

Whether you’re flipping properties, planning your next project, or just staying ahead of the game, we’ve got the inside scoop to help you crush it this month. Let’s dive in and turn February into a game-changer!

U.S. Home Prices Increased by 0.6% in January.

In January 2025, U.S. home prices saw a 0.6% increase compared to the previous month, marking a slight acceleration from the 0.5% growth observed in the prior three months. The last time prices rose faster was in November 2023, with a 0.7% jump. This data comes from the Redfin Home Price Index (RHPI), which tracks seasonally adjusted price changes for single-family homes using the repeat-sales method. The index reflects the sale prices of homes sold during a given period and compares them to previous sales of the same properties.

On a year-over-year basis, home prices grew 5.4% in January, which is the slowest annual increase since August 2023. Despite the slight uptick in month-to-month growth, Redfin’s Senior Economist Sheharyar Bokhari suggests that “this momentum may not last”. The growth in January was largely driven by homes that went under contract in December, and since then, a slowdown in sales and an increase in listings have been observed.

This shift is expected to result in a slight cooling of price growth, as homes are staying on the market longer and selling at an average of nearly 2% below their list price—marking the biggest discount in almost two years.

In 2024, fewer than one-third of U.S. home purchases were made in cash, marking the lowest level in three years.

In 2024, just under one-third (32.6%) of U.S. home purchases were made in cash, a decrease from 35.1% in 2023 and the lowest level since 2021. However, cash purchases still represented a higher share than pre-pandemic levels, which ranged from 25% to 30%.

Home purchase records from 40 major U.S. metros, reflects a broader trend in the market. One key factor behind the drop in cash sales is the reduced activity of investors, who historically make up a large portion of all-cash buyers. With rising home prices and mortgage rates, fewer investors are purchasing homes, contributing to the decline.

Despite the decrease, cash purchases remain more common among wealthier buyers, particularly as home prices remain high. While the share of all-cash sales may not decrease much further in 2025, unless mortgage rates drop significantly, they are likely to stay relatively stable.

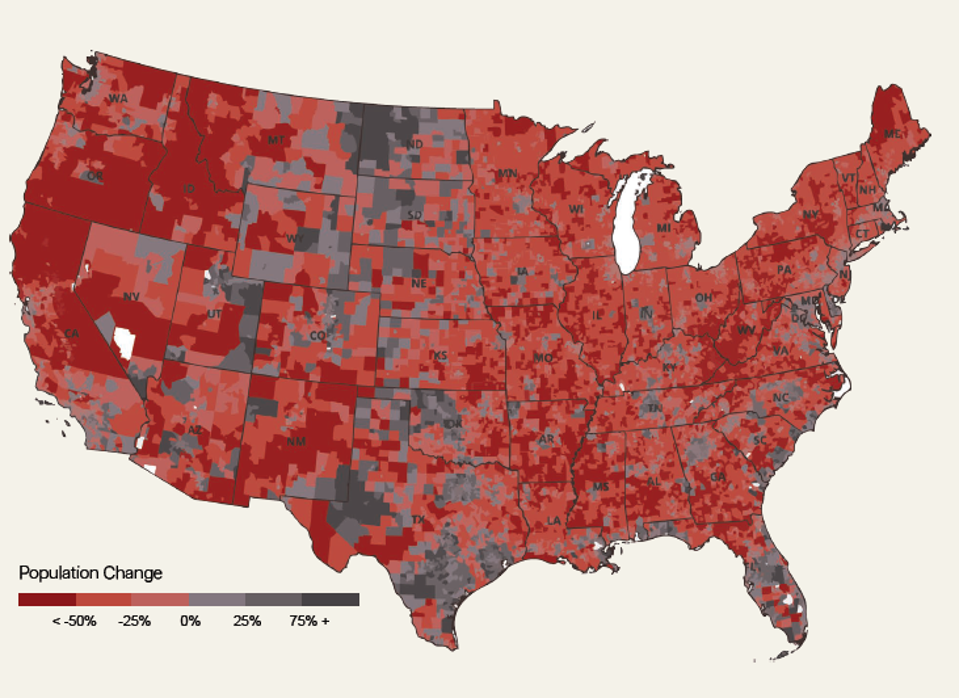

Climate Resiliency Turns the Housing Market on Its Head

The aftermath of the devastating wildfires in Los Angeles is expected to leave the housing market struggling to recover for years. Resiliency data reveals that shifts in the market are already underway, with far-reaching effects that will not only influence the local area but create lasting patterns across the country. When rebuilding efforts begin in a region like Los Angeles, new challenges emerge that intertwine with the market’s existing housing difficulties. Stakeholders are faced with overwhelming bureaucratic hurdles, unusually high costs for materials and labor, and the additional burden of remediation efforts required after the fires. While the process of reconstruction is undeniably complex, the impact of climate events like these extends beyond immediate rebuilding, leaving enduring marks on the housing market in ways that go much deeper. Skylar Olsen, the chief economist at Zillow, is closely examining the data surrounding the Los Angeles market to assess both the short-term and long-term effects of the recent wildfires, particularly their influence on housing affordability in the area moving forward.

Sources:

Sources: redfin. Forbes. attom.