Hey there! Welcome to the September 2024 Real Estate Market Update! As we shift into fall, let’s keep our fingers on the pulse of the housing scene. Join us for a lively look at the latest trends, exciting opportunities, and predictions from the pros. Whether you’re buying, selling, investing, or just curious about what’s happening, this update is packed with insights to help you thrive in today’s ever-changing market. Let’s jump into the September real estate adventure together and see what the future has in store for us!

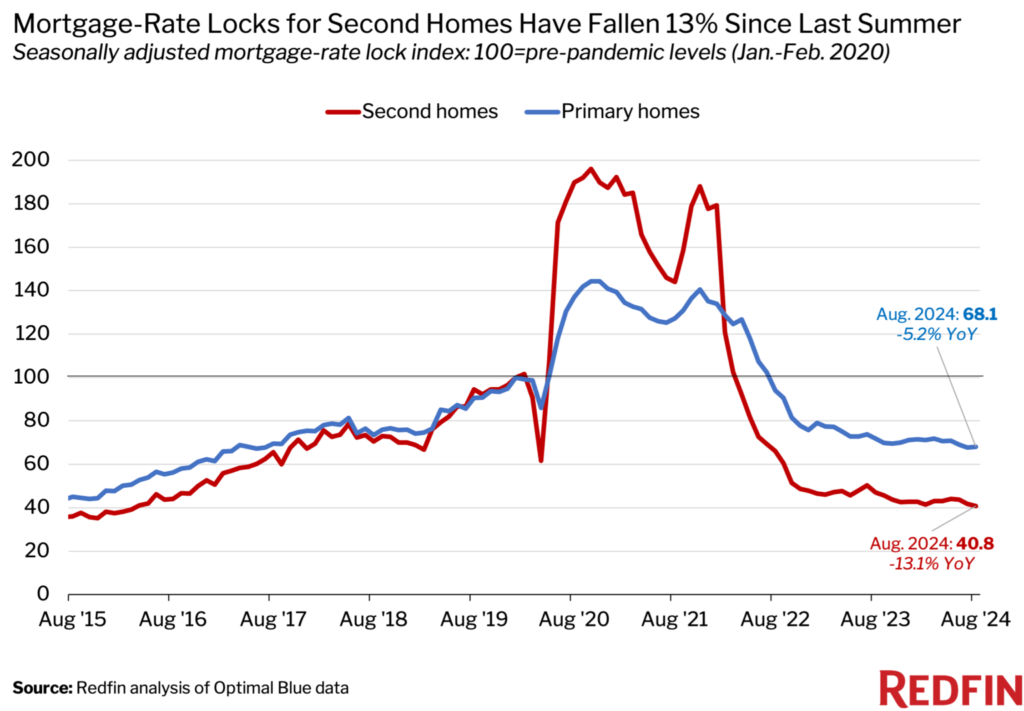

Demand for Second-Home Mortgages Hits Lowest Level in Eight Years

In August, mortgage-rate locks for second homes fell 13.1% year-over-year to their lowest level since March 2016, while locks for primary homes declined 5.2%. Second-home rate locks were down 59.2% from pre-pandemic levels, compared to a 31.9% drop for primary homes. According to Redfin's analysis of Optimal Blue data, mortgage demand is weak overall due to high home prices and interest rates, with second-home demand particularly sluggish for several reasons: Many second-home buyers can afford to pay cash and avoid high mortgage rates. With rates still more than double their pandemic lows, it's often financially smarter to use cash for purchases rather than taking out a mortgage. Second homes are more expensive and less essential than primary residences. As costs rise, potential buyers are hesitant. The average price for a home in seasonal areas was $589,162 in August, up 4.1% from last year, compared to $437,787 in non-seasonal areas, up 4.7%. Increased loan fees for second homes also add to the cost. With more companies requiring office attendance, people have less time for vacation homes. Stagnant rents and reduced revenue from short-term rentals, plus new restrictions, make buying for rental income less appealing. Economic uncertainty and concerns about a potential recession are causing hesitation for large purchases.

What Homebuyers and Sellers Can Anticipate This Fall

Mortgage rates have recently decreased to 6.5% for a 30-year fixed mortgage, down from a peak of 7.8% last October. This is the first year-over-year reduction in monthly mortgage payments since 2020, providing some relief for homebuyers. However, significant short-term drops in rates are unlikely, as the Federal Reserve is expected to start lowering interest rates on September 18. The exact impact on mortgage rates will depend on upcoming economic data. If the labor market remains strong, rate cuts may be gradual, potentially causing a slight increase in mortgage rates this fall. Conversely, weaker labor data could lead to more substantial rate cuts, reducing mortgage rates further.

For Homebuyers: Timing the Market is Challenging

While recent rate drops make buying slightly more affordable, timing the market perfectly is difficult. Potential buyers may hesitate, hoping for lower rates or better deals, but this could lead to increased competition and bidding wars as fall progresses. Those ready to buy might benefit from locking in the current rate of 6.5% and potentially refinancing later if rates fall further. It’s wise to focus on finding a home that fits your budget and needs rather than waiting for ideal conditions.

For Home Sellers: Pricing and Strategy Matter

Home sellers face a slow fall market and increased buyer hesitancy, making strategic pricing crucial. Overpricing can lead to extended market times and necessary price reductions. However, well-priced homes in low-inventory areas are still attracting strong interest and multiple offers. Sellers should also consider the impact of changes in buyer’s agent compensation, as this could affect the negotiation process and offers received.

Wealthy Homebuyers Are Increasing Their Budgets to Keep Up with Rising Prices

Despite challenging economic conditions, affluent home buyers across the U.S. are increasing their budgets. According to a WSJ Intelligence survey, their average budget for a home purchase in the coming year has risen to $2.038 million—an 8% increase from last year, aligning with the 9% rise in luxury home prices. This marks the first time the average budget for a primary residence has surpassed $2 million.

The survey, conducted with nearly 4,000 Wall Street Journal readers, shows that while luxury homebuyers are optimistic about the market, they remain mindful of economic factors. Most respondents are more positive about the property market compared to earlier in the year, despite high mortgage rates.

Price remains the top factor influencing homebuying decisions, with 86% of those with a net worth below $5 million and 80% of those with over $5 million citing it as a key concern. For those with lower net worth, interest rates are the second-highest concern, while for the wealthier group, market volatility and portfolio performance take precedence. Inflation is a third major concern for both groups.

Notably, 39% of respondents plan to buy their home with cash, while 48% intend to finance with a mortgage and a down payment.

Sources:

Sources: redfin. Forbes. attom.